Home → Updates → Legal → The Carbon Accounting (Provision for 2018) Regulations 2020 SI 2020/115

The Carbon Accounting (Provision for 2018) Regulations 2020 SI 2020/115

Jurisdiction: UK

Commencement: 28th February 2020

Summary

These Regulations place duties on the Government and Secretary of State. There are no compliance duties for organisations.

The principal reason for these Regulations (the ‘2020 Regulations’) is to ensure the accounting for the European Union Emissions Trading Scheme (EU ETS) at stationary installations and domestic aviation covers the first year (2018) of the third carbon budget period by:

- providing a mechanism to account for credits and debits to the net UK carbon account as a result of the operation of the EU ETS, other than in respect of aviation during 2018; and

- providing a mechanism to account for domestic aviation during 2018 which is included in the EU ETS.

Provisions for carbon accounting are made to determine the net UK carbon account (the amount of net UK emissions of targeted greenhouse gases for the period, either reduced or increased by the amount of carbon units in accordance with these 2020 Regulations).

The amount of net UK carbon accounting for different periods determines whether the targets relating to emission reductions have been met. These 2020 Regulations are relevant to the third carbon budget covering 2018-2022.

Crediting and debiting carbon units

EU ETS (stationary installations)

For the first year of the third budget period, EU Member States did not receive a national cap of emission units due to the EU ETS operating at installation level. Therefore instead of using a fixed cap, a notional cap (known as the annual allocation) is created by adding together the volume of EU allowances to UK operators. The UK notional cap is 152,311,507 carbon units.

Circumstances in which carbon units are to be credited to and debited from the net UK carbon account in 2018 as a result of the operation of the EU ETS in that year are set. If the amount of carbon units surrendered by operators of installations in the UK in 2018 was:

- Greater than 152,311,507, an amount of carbon units equal to the difference is to be credited to the net UK carbon account in 2018.

- Less than 152,311,507, an amount of carbon units equal to the difference is to be debited from the net UK carbon account in 2018.

Domestic aviation carbon units

Currently the EU ETS provides a cap for aviation emissions and units to confirm compliance. It does not provide a cap for UK only domestic aviation emissions (flights between UK airports), therefore it is not possible to distinguish between domestic aviation emissions and international aviation emissions.

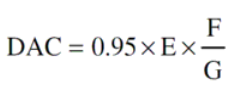

Carbon units to be credited or debited from the net UK carbon account must take into account domestic aviation emissions during 2018. The domestic aviation cap (DAC), expressed in tonnes of carbon dioxide equivalent, must be calculated in order to find out which carbon units are to be credited and debited. The calculation can be found below:

E is the mean of the EEA aviation emissions for the years 2004, 2005, and 2006.

F is the domestic aviation emissions for 2010.

G is the EEA aviation emissions for 2010.

If domestic aviation emissions in 2018 were:

- greater than the domestic aviation cap, an amount of carbon units equal to the difference is to be credited to the net UK carbon account for 2018.

- less than the domestic aviation cap, an amount of carbon units equal to the difference is to be debited from the net UK carbon account for 2018.

Cancelling carbon units credited to the net UK carbon account

During a period beginning on 1st January 2023 and ending on 14th May 2024, the Secretary of State (SoS) must ensure that each carbon unit credited to the net UK carbon account, in respect of 2018 is cancelled; this is to help meet the third carbon budget.

Credited carbon units will also be cancelled under these 2020 Regulations if an equivalent operation under Regulation (EU) 389/2013 establishing a Union Registry is performed.

The Legislation Update Service is the best way to stay up to date automatically with legislation in England, Wales, Scotland, Northern Ireland and the Republic of Ireland.

Sign up for your free trial to get instance access.

These summaries (The Compliance People Materials) are provided free of charge as an example of the Legislation Update Service’s content. They are not intended to constitute legal advice for any specific situation. The Compliance People Materials are general and educational in nature and may not apply to the specific facts and circumstances of individual cases. The Compliance People does not accept any responsibility for action taken by you or any User as a result of any The Compliance People Materials provided by us. You should take specific legal advice when dealing with specific situations.